Understanding NRI Accounts and Taxation: Types and Implications — Part 2

An NRI’s income taxes in India will depend upon his/her residential status for the year.

If your status is ‘resident’, your global income is taxable in India. If your status is ‘NRI,’ your income earned or accrued in India is taxable in India.

An individual will be treated as a Resident in India in any previous year if he / she satisfies any of the following conditions:

1. If he / she is in India for a period of 182 days, or more during the previous year or

2. If he / she is in India for a period of 60 days or more during the previous year and 365 days or more during 4 years immediately preceding the previous year.

The Finance Act 2020 has amended the residency provisions to include Indian Citizen/Person of Indian Origin, who comes to visit India and shall now be considered as RNOR subject to the following conditions:

1. Total income other than foreign income is Rs 15 lakh or more.

2. The individual has stayed in India for more than 120 days but less than 182 days in the previous year.

3. The individual has stayed in India for 365 days or more in four years preceding the previous year.

Before this amendment, such individuals were classified as non-residents. Due to the amendment mentioned above, the individual’s residential status may be classified as RNOR, which will lead to increased scope of total income for taxability, loss of various exemptions allowed, etc.

It is to be further noted that in the above amendment, an individual staying for more than 182 days shall be classified as a resident irrespective of the level of income in the previous year.

Deemed residency status introduced in Finance Act 2020

Finance Act 2020 introduced the concept of ‘Deemed residency’. According to this, Citizens of India earning more than Rs 15 lakh from Indian sources shall be deemed a resident of India if they are not liable for payment of taxes in any other country.

The deemed residents shall be classified as RNOR w.e.f FY 2020–21. This amendment was brought into force to tax the incomes of Indian citizens who are not liable to pay tax in any country.

Did you know?

Residency is defined differently in the IT Act, 1961 and the Foreign Exchange Management Act, 1999 (FEMA).

An individual will be considered a ‘Resident in India’ under FEMA based on their intent to stay in India. FEMA residency is essential for individuals interested in foreign exchange transactions such as investments in foreign currency or foreign securities, acquisition or transfer of immovable property, etc.

Residency under the IT Act is determined only based on the physical stay of the individual in India, irrespective of the purpose of stay. Residency under the IT Act will help you determine your taxable income and the applicable tax rates.

Rates of Tax

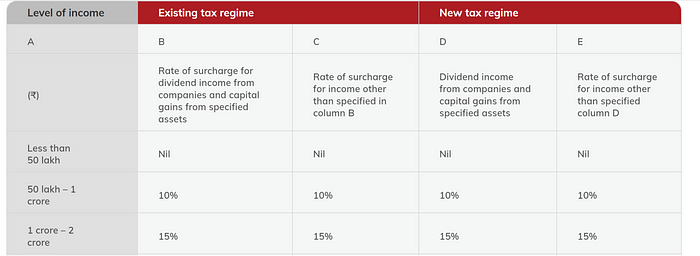

The surcharge is an additional tax levied on your base income tax when your taxable income crosses ₹50 lakh. Additionally, you are liable to pay a health and education cess of 4% on income tax as well as the surcharge . These rates are the same for resident Indians and NRIs.

The rate of surcharge based on income level is provided below:

Rebate u/s 87A

The rebate under section 87A of a maximum of Rs.12,500 is not allowed to a Non-resident.

Benefits of basic exemption limit

As a Non-resident, will still get the benefit of the basic exemption limit of Rs. 2,50,000 from total income. However, if total income in India consists of only short-term capital gains or long-term capital gains, then the benefit of the basic exemption limit is not available with respect to such gains.

Visit to know more about NRI Taxation Or www.gorantlaassociates.com

Continue Read:

Understanding NRI Accounts and Taxation: Types and Implications — Part 2

Navigating NRI Capital Gains and Taxation: A Comprehensive Guide for Post-2018 Rules — Part — 3

Disclaimer:

This Article/Blog has been contributed by Butchibabu Gorantla, B.Com, FCA, FCS, Chartered Accountant. This article/blog is posted with due authorization from the author for the academic purposes. The views and opinions expressed herein are those of the author and don’t constitute a legal advice to any user.

Related Posts

A Comprehensive Overview of the Finance Bill 2024

The Finance Bill 2024, introduced in the Lok Sabha, seeks to implement the financial proposals…

The Provisions of the Finance Bill, 2024: A Comprehensive Overview

The Finance Bill, 2024, introduces several amendments to the Income-tax Act, 1961, and other related…

Understanding the Income Tax Slab Rates for FY 2023-24, AY 2024-25: New vs. Old Tax Regimes

The income tax slab rate is the percentage of tax you pay on your income,…

Which ITR Form is Right for You? Find Out Now!

Filing your Income Tax Return (ITR) in India is an essential responsibility. However, with various…