Filing your Income Tax Return (ITR) in India is an essential responsibility. However, with various ITR forms available, choosing the right one can be confusing. Selecting the wrong form can lead to delays, complications, and even penalties.

This blog post is your one-stop guide to understanding the different ITR forms in India. We’ll break down what each form is for, who can file it, and the key factors to consider when making your choice.

By the end of this post, you’ll be able to confidently identify the correct ITR form for your specific tax situation and ensure a smooth filing process. So, grab a cup of coffee, and let’s dive into the world of ITR forms!

Understanding ITR Forms

The Income Tax department in India provides various ITR forms to cater to different taxpayer categories and income sources. Each form has its own specific set of rules and requirements. Here’s a breakdown of the concept of ITR forms and their role:

Categorization by Income Source

ITR forms primarily categorize taxpayers based on their income sources. For instance, salaried individuals have different filing needs compared to business owners or professionals. Choosing the right form ensures you report your income accurately and efficiently.

Role of the Income Tax Department

The Income Tax department prescribes these ITR forms to simplify the tax filing process for different taxpayer segments. Each form outlines the specific sections and schedules you need to fill out based on your income sources and deductions.

By understanding the basic purpose of ITR forms and their role in categorizing taxpayers, you’ll be better equipped to choose the most suitable form for your situation.

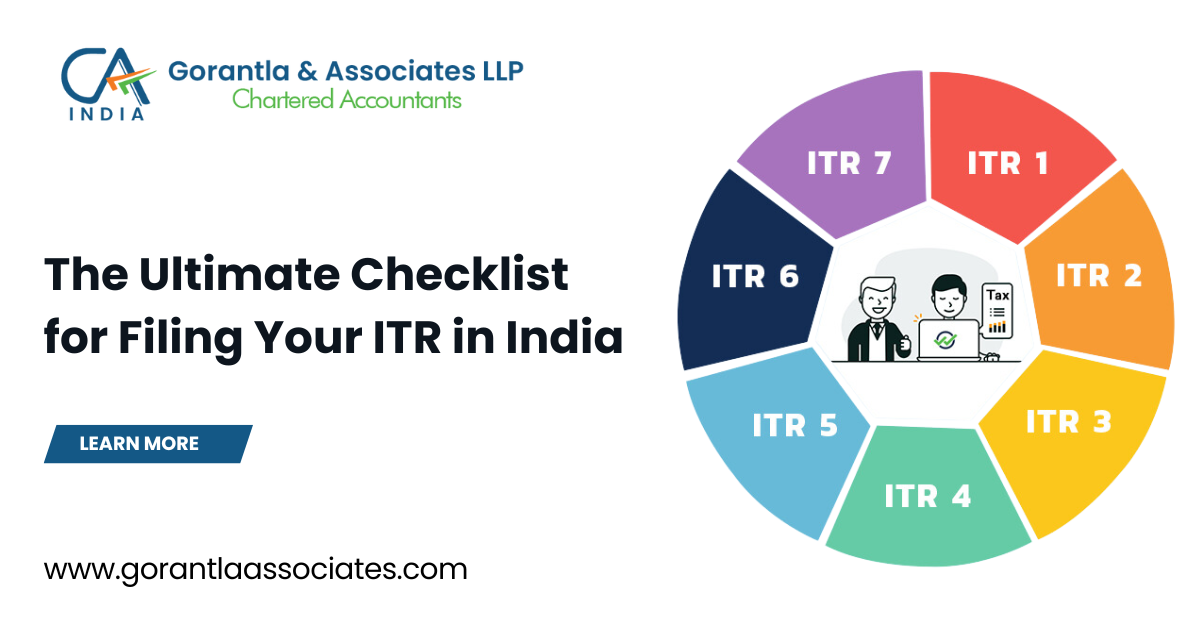

Breakdown of Common ITR Forms in India

Understanding the purpose of ITR forms and their role in categorizing taxpayers is crucial for selecting the right one. Here’s a detailed breakdown of some of the most commonly used ITR forms in India:

ITR-1 (Sahaj)

Who can file it: This is the simplest ITR form, ideal for resident individuals with income below a certain limit (specified by the Income Tax department every year). It caters to those with income from:

- Salary

- Pension

- One house property (rental income)

- Interest income from savings account

- Other sources like lottery winnings (up to a certain limit)

Advantages: Easy to use, minimal information required, suitable for taxpayers with straightforward income sources.

Limitations: Restricted to specific income sources and amounts. Not suitable for individuals with:

- Business income

- Capital gains exceeding a certain limit

- Foreign Income

ITR-2

Who can file it: Individuals and Hindu Undivided Families (HUFs) with income from sources other than business or profession. This includes:

- Salary income

- Pension income

- Income from multiple house properties

- Capital gains

- Foreign Income

- Interest income from various sources

- Dividends, etc.

Advantages: More flexibility compared to ITR-1, accommodates a wider range of income sources.

Limitations: Slightly more complex than ITR-1, requires detailed information on various income sources.

ITR-3

Who can file it: Individuals or HUFs with income from business or profession (carrying on a business or profession).

What income sources it covers:

- Business income (requires detailed profit and loss account and balance sheet)

- Income from profession

Advantages: Suitable for business owners and professionals, allows detailed reporting of business income and expenses.

Limitations: Requires detailed bookkeeping records and knowledge of business income reporting.

ITR-4 (Sugam)

Who can file it: Individuals, HUFs, and partnership firms with income under a certain limit and availing benefits under the presumptive taxation scheme.

What income sources it covers:

- Income from business or profession under the presumptive taxation scheme (where income is estimated based on a fixed percentage of turnover).

Advantages: Simpler for small businesses availing presumptive taxation benefits, minimal information required.

Limitations: Restricted to specific businesses under the presumptive scheme and income limits.

Additional ITR Forms (Briefly Mention)

- ITR-2A: For certain categories of individuals who have received income from sources for which tax has been deducted at source (TDS) and whose total income does not exceed Rs. 5 lakh. It is a pre-filled form provided by the Income Tax Department.

- ITR-4S: A simplified version of ITR-4 designed for small businesses and professionals with business income up to Rs. 50 lakh and professional income up to Rs. 50 lakh.

- ITR-5: For firms, LLPs, AOPs, BOIs, and other non-individual entities.

- ITR-6: For companies other than those claiming exemption under section 11.

- ITR-7: For individuals and entities filing returns under specific sections like trust income, etc.

Choosing the Right ITR Form: A Decision Tree Approach

Selecting the correct ITR form can seem daunting, but it doesn’t have to be. Here’s a decision tree approach to simplify the process and help you choose the right form based on your income situation:

Step 1: Residency Status

- Resident Indian: Proceed to Step 2.

- Non-Resident Indian (NRI): You cannot file ITR-1 (Sahaj). Consult a tax advisor for guidance on the appropriate ITR form for NRIs.

Step 2: Nature of Income

- Salary income only: If your income solely comes from salary and you don’t have any other income sources like capital gains, house property, etc., proceed to Step 3A.

- Income from other sources: If you have income from sources other than salary (e.g., rental income, interest income, capital gains), proceed to Step 3B.

Step 3A: Salary Income Only

- Total income below the specified limit (as per the Income Tax department): You can file ITR-1 (Sahaj).

- Total income exceeds the specified limit: You cannot file ITR-1 (Sahaj). Consider ITR-2 or consult a tax advisor for guidance.

Step 3B: Income from Other Sources

- Business or professional income: Proceed to Step 4.

- Income from other sources only (capital gains, house property, etc.): Consider ITR-2 if your income falls within the eligibility criteria for this form (no business income). For higher income or complex situations, consult a tax advisor.

Step 4: Business or Profession Income

- Income under the presumptive taxation scheme and below the specified limit: You can file ITR-4 (Sugam).

- Income above the presumptive scheme limit or not covered under the scheme: You need to file ITR-3. This requires detailed bookkeeping records.

Additional Considerations

- Capital gains: If you have capital gains exceeding the specified limit, you might need to file ITR-2 even if your income falls under the ITR-1 limit.

- Foreign income: If you have any foreign income, you might need to file an ITR-2 or consult a tax advisor depending on the complexity.

Remember: This is a general guide. If your income situation is complex or you have any doubts, it’s always recommended to consult a tax advisor for personalized advice on choosing the right ITR form.

By following this decision tree and considering the additional factors, you’ll be well on your way to selecting the appropriate ITR form for your situation.

Effortless ITR Filing with Gorantla Associates

Choosing the right ITR form is a great first step, but gathering data and completing the filing process can still be time-consuming. Gorantla Associates, a trusted accounting and taxation service, can help you get your data for ITR filing ready in no time.

- Expert Guidance: Our team of experienced tax professionals will guide you through the entire filing process, ensuring accuracy and compliance.

- Comprehensive Support: From collecting and organizing your financial data to final submission, we handle all aspects of ITR filing.

Focus on what you do best, and let Gorantla Associates handle the complexities of tax filing. Visit our website or contact us today to get ready for ITR filing!

Also Read:

The Ultimate ITR Filing Checklist: Your Comprehensive Guide to a Stress-Free Filing Experience

Related Posts

A Comprehensive Overview of the Finance Bill 2024

The Finance Bill 2024, introduced in the Lok Sabha, seeks to implement the financial proposals…

The Provisions of the Finance Bill, 2024: A Comprehensive Overview

The Finance Bill, 2024, introduces several amendments to the Income-tax Act, 1961, and other related…

Understanding the Income Tax Slab Rates for FY 2023-24, AY 2024-25: New vs. Old Tax Regimes

The income tax slab rate is the percentage of tax you pay on your income,…

The Ultimate ITR Filing Checklist: Your Comprehensive Guide to a Stress-Free Filing Experience

Filing your Income Tax Return (ITR) in India is a crucial responsibility, but navigating the…